Content

- Crypto Tracker | Trading Notebook | Investment Tracker

- What is the best and cheapest bitcoin wallet?

- Key Considerations When Choosing a Bitcoin Wallet

- Paper Wallets & Other Cryptocurrency Storages

- Crypto Seed Word Wallet Stainless Steel Pipe Bitcoin BIP 39 to Number ledger/trezor Backup Recovery 0 – 9 Stamps

- Results for bitcoin paper wallet

Each time you deliver a payment, a phantom address and a corresponding key pair are generated in the background. Since Bitcoin clients do this task automatically, the user is protected from the complexities of this method. Advast Suisse supports clients in the conception, creation and implementation of high quality, durable and counterfeit-proof paper wallets/crypto certificates. If any error occurs during the process of the private key generation, it must be aborted immediately to avoid the generation of a “compromised” private key generated by a default value.

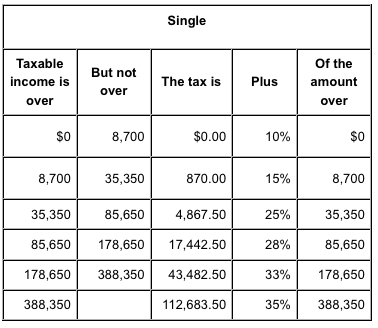

They are guaranteed to be a talking point at any Christmas table if given as gifts and are an excellent educational tool without having to require someone own an exchange account to own Bitcoin. When held for a year or two, Bitcoins inevitable price appreciation will always make it a gift that keeps on giving. The table below, taken from a “Bitcoin-101” presentation we do for financial firms trying to understand this new asset class, summarizes the many ways you can own Bitcoin.

Crypto Tracker | Trading Notebook | Investment Tracker

Import a private key from a BIP38 encrypted Bitcoin paper wallet to a Bitcoin Core (Bitcoin-QT) client wallet. If you’re concerned about getting locked out of your Bitcoin wallet, you may focus on those providers who retain custody of your key. However, if the lack of centrality of crypto is what appeals to you, you may opt for a crypto wallet where you retain complete control of your key—and, by extension, your coins.

- This article will help you understand more about the importance of bitcoin wallets and how to select the most suitable one for you.

- A hardware wallet is an excellent device for securing digital currencies and must be kept safe at all times.

- Otherwise, you risk giving away your money to automated thieves.

- He is passionate about cryptocurrency as an emerging technology and is heavily involved in the fast-growing fintech space.

- This tab likewise permits you to dispose of the irregular number generator used to make the Bitcoin keys instead of utilizing your passphrase or another arbitrary expression.

- WikiJob does not provide tax, investment or financial services and advice.

You’ll see that there’s a drop-down that permits you to change your wallet’s plan, language, or even the digital currency . This means that you need to import the Private Key WIF Compressed.

What is the best and cheapest bitcoin wallet?

In case you’re gifting a Bitcoin paper wallet you ought to disclose to the beneficiary about these wellbeing safeguards too and attempt to blessing, in any event, two duplicates of the wallet. Here’s a nice video that the maker of Bitcoinpaperwallet.com set up to show you the appropriate method of cutting, collapsing and fixing your paper wallet. Enter the 24-word passphrase into the crate and snap the “Arbitrary Generate New Wallet” button. You may get an admonition about not utilizing a Bitcoin Wallet Import Format private key. Just snap, OK, and the new open location and secret key will be produced dependent on your passphrase. That passphrase would now be utilized to recuperate this wallet if the private key is ever lost.

A wallet is the addresses used to pay into and from your bitcoin. The public key allows you to receive bitcoins and provides evidence that you actually own the coins, whereas the private key allows you to send them. The way a hardware wallet works is that it stores private keys in the form of seed phrases. When a user wants to receive or send a bitcoin, a private key should be chosen. The private key is different from public keys because it is generated by the hardware wallet, which means that no one can access this key.

Key Considerations When Choosing a Bitcoin Wallet

Almost all cryptocurrency theft incidents that have occurred during the last years are related to improper private key generation or management. One way to safeguard against this is to print multiple copies of your paper wallet and keep the others safely locked away. If you choose to do this make sure they’re safe and only you know where they are. Paper wallets typically involve printouts of two QR codes, one for the public key , and one for the private key (what you use for paying other people – like a bitcoin PIN). The keys themselves are also usually printed, the public key visibly and the private key concealed.

A fresh operating system- boot your computer from a fresh operating system to ensure you have no malware on your computer. Cryptocurrency wallets have been compromised in this manner in the past.

Paper Wallets & Other Cryptocurrency Storages

This type of fund flow is classified as “peeling chain” behind the transfer behavior. Having the certainty that the hacker has the private key of the target address, as soon as any funds go into the wallet, those funds are transferred away. Such backdoors have been already detected in some very well-known paper wallet generation websites, like WalletGenerator.net and BitcoinPaperWallet.com. https://www.tokenexus.com/ Some of these modifications are more obvious and harsh, while others are much more subtle. As a final warning, although a paper wallet is un-hackable, you do face the risk of losing the wallet, just like any other currency note or high value bearer bond. So, take care to store it in a safe place or even keep multiple copies of it if you have loaded it with a large sum of money.

Unlike options such as Coinbase and Binance, Exodus does not hold funds or store user credentials or private keys, so it cannot access a users wallet or cryptocurrency. Crypto.com has more than 10 million users and provides services in 90+ countries globally.

Crypto Seed Word Wallet Stainless Steel Pipe Bitcoin BIP 39 to Number ledger/trezor Backup Recovery 0 – 9 Stamps

If you are holding bitcoins for any length of time keep them in an offline wallet for extra security. Hardware wallets are dedicated devices that hold your bitcoins and handle the transactions. These can be extremely secure – so long as you don’t lose the device. There are a range of different cryptocurrency wallets to choose from, including paper, desktop, mobile, web-based and hardware options. The industry-leading security and protection for assets stored in the wallets are backed by the exchange being the first major exchange to launch support of SegWit and now offers native SegWit addresses. There is a fully insured hot wallet, as well as institutional-grade cold storage, and both support all listed assets with upgrades available as and when new cryptocurrencies are added to the exchange.

- If a user buys a hardware device but wants to use an unsupported cryptocurrency, they must what is a paper wallet wait for the developers to add support for it.

- There is typically another password involved to make the connection, which increases security but also raises the risk you may lock yourself out of your crypto if you lose the password.

- This means you may be able to regain access if you lose your key by contacting them.

- These words, or pin, will mean you can access your cryptocurrency wallet from anywhere.

- When you first plug it into your computer and set it up, you will choose a PIN to protect the device from unwanted access.

- It functions similarly to cold wallets, or offline wallets, and is specified under its umbrella, but shares similarities with hot wallets, too, wherein public and private keys are involved.

- Bitcoin wallets not only hold your digital coins, but they also secure them with a unique private key that ensures that only you, and anyone you give the code to, can open your Bitcoin wallet.

Some traders put it in safes, while others find inserting it in common items, like books, protects it better in an unobvious way. Crypto wallets are software programs that aid in the updates of the crypto’s blockchain. Paper wallets were a popular choice for traders when Bitcoin was still gaining fame in the market. It’s simple to acquire, store, and use, and for these reasons it was the top choice before. But now, what is a bitcoin paper wallet more wallet types have been introduced to the market, and users have embraced the diversity of choices. For the long-term storage of cryptocurrencies such as Bitcoin or Ethereum, it is recommended not to leave the crypto assets on an exchange for security reasons, but to store them securely instead. CYBAVO is a cybersecurity technology provider offering digital asset custody and management solutions for enterprises.

Author: Tomi Kilgore