Contents

Here are the rules to trade in a bullish ABCD pattern. Do not trade in “Options” based on recommendations from unauthorised / unregistered investment advisors and influencers. Update your e-mail and phone number with your stock broker / depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. Calculating the entry point is now a matter of technique – point C will be at a distance of 161.8% of the corrective wave A-B. You can use any preferred oscillator, for example, RSI, to confirm the input.

At level 4, the sample is complete and purchase indicators are generated with an upside goal that matches point 3, point 1, and a 161.eight% improve from level 1 as the ultimate price target. Oftentimes, level 0 is used as a stop loss stage for the general trade. Harmonic trading in the currency market contains the identification and the analysis of a handful of chart figures. When mixed, harmonic sample evaluation and market context give a fantastic edge to commerce. Harmonic patterns can fail, but their failure ranges are well-defined and that information is clearly recognized prior to the trade.

Starting from very basics of markets to explain harmonic pattern in detailed. The rhythmic value maneuvers produce symmetric rallies and decline to give traders leeway to determine the key defining moments. Symmetry can be observed in all markets and in different time frame charts. In this manner, we expect that this valid ABCD pattern leads to a bullish price move.

Superior Services for day traders

The Harmonic Shark pattern is a moderately new trading pattern that was found in 2011 by Scott Carney. The shark pattern is fairly like the crab pattern recognized by the overextended swing/turn point. It’s a mind-boggling technique that includes three exchanges, yet it has a generally low forthright expense. Nonetheless, uncommon for an alternatives trading system, it tends to be set up utilizing either calls or puts for generally a similar return.

How much does a million dollar CD earn?

Certificates of Deposit

As of February 3rd, 2021, the average rate on a jumbo 24-month CD is 0.21% APY. The interest earned on this would be $4,204.41.

The proprietary Trading Systems Scanner also lets you run a detailed Scan at End-of-Day … The scan results include detailed statistics of automated Buy and Sell signals for an eligible Symbol, from the origin of trading to the present traded day … A typical detailed proprietary Trading System Scan includes … Technical Indicator Scans are indicator-based algorithms that scan symbols at End-of-Day, End-of-Week or End-of-Month for potential Bullish and/or Bearish signals.

Chart Pattern Screener for Indian Stocks from 5 Mins to Monthly Ticks

If you come across any individual or organisation claiming to be part of Enrich Money and providing such services, kindly intimate us immediately. Of course, one of the most important stages is determining the right place to set a stop-loss. A fairly universal solution is the triple value of the ATR indicator. However, in most cases, we just need to find the point at which the current markup will lose its relevance. So, to start, let’s see what kind of tools we really need. First of all, if you are a beginner, and still have problems with determining the extremes on the chart, the ZigZag indicator will be very useful.

Also, the ATR indicator will be required to calculate the stop loss. If desired, of course, you can use any other indicator of volatility. If this condition is not met, a sequence recalculation is also required. The final cycle of A-B-C correction usually ends just in the region of the 4th wave. I am regular follower of your site especially Amibroker AFLs. I can say your blog is one of the best Technical analysis blogs in world which i have ever seen, Thanks a lot for sharing such educational and highly skillful ideas with us.

- No point getting all the data if you can’t actively manage the portfolio each day.

- It will be very helpful to if you could tweak AFL as requested.

- The harmonic pattern is in most cases symmetrical and ends either at 127.2% or at 161.8% of the Fibonacci expansion.

- Using this method removes the threat of heavy losses and case permitting offers the opportunity to recuperate those smaller losses and make a profit.

- Candlestick analysis focuses on individual candles, pairs or at most triplets, to read signs on where the market is going.

And sorry to say, please do not get offended, from the article above, it feels like you aren’t spending sufficient effort and time into this sort of study and trading. However harmonic patterns are more prominent in vary markets as a result tradeallcrypto of way it is constructed, causing merchants to miss opportunities in trending markets. Most harmonic sample commerce entries happen round “D” point throughout the reversal zone. You can turn off individual patterns on the settings screen.

You can find information about above patterns in below link. Soon sufficient, merchants realized that these patterns could also be applied to different markets. Since then, numerous books, trading software program, and different patterns have been made primarily based on the Gartleys. Its obvious that we all want profitable methods and for them to perform well. Also over time we see adjustments in the markets and these need to be taken into account. No point getting all the data if you can’t actively manage the portfolio each day.

Motor Winding Tips

ABCD is a strong pattern with significant risk/reward opportunities. There is also an exception, where CD is 127.2 or 161.8 percent of AB. However, in both cases of classic and extension, a trade is planned at point D. Do not share of trading credentials – login id & passwords including OTP’s. Check your securities / MF / bonds in the consolidated account statement issued by NSDL/CDSL every month.

Find the pattern in the chart, where A is significantly high, and B is extremly low. There is no point higher than A or below than B in the range between A and B. Ideally, the IC Markets Forex Broker Review length of BC is 61.8 or 78.6 percent of AB. We at Enrich Money do not provide any stock tips to our customers nor have we authorised anyone to trade on behalf of others.

Can you retire 2 million?

Yes, you can retire at 55 with 2 million dollars. At age 55, an annuity will provide a guaranteed income of $112,500 annually, starting immediately for the rest of the insured's lifetime. The income will stay the same and never decrease.

The Gartley pattern above exhibits an uptrendfrom level zero to point 1 with a value reversal at level 1. Using Fibonacci ratios, the retracement between point 0 and point 2 should be sixty one.8%. At level 2, the worth reverses once more toward point 3, which should be a 38.2% retracement from point 1. Harmonic chart patterns are considered harmonic because these buildings have an integral relationship with the Fibonacci quantity series.

NSE Asian Paint (EWT): Money printing time

You can expect the price to move UP where you need to enter into buy order. D point will be below all other three points of ABCD pattern. As a first step, use the first swing which will make A-B leg. When you have the first leg then you need to wait until the market reverses back from the B point towards A point.

They are meant for when the markets are in some type of consolidation. And I will also say you might be appropriate with your statement that harmonic patterns miss out on the trend since we have strong targets. A number of traders have lost their money in the market due to wrong trading advice or emotional decisions. We keep on getting a number of requests for helping these traders recover their lost money. We are proud to say that till date we have helped 1368 people recover their lost money. Get Back your lost money with our Precision Tips backed by timely info, accurate technical analysis which is backed by 30 Days Money Back Guarantee.

To change the character in every iteration you can set a counter and increment it by 1 every time in the inner loop. To create this simply create 2 nested for loops where the outer loop repeats a row and the internal loop prints the character in a column. You can find a link to download the ABCD pattern indicator below. As with the bullish ABCD pattern, the bearish pattern begins with a sharp move to the upside.

In a lot of the cases these patterns consist of 4 value moves, all of them conforming to particular Fibonacci ranges. Therefore, a harmonic chart sample ought to all the time be analyzed using Fibonacci Retracement and Extensions tools. Just like each different patterns, have a look at the overall context earlier than applying it.

How accurate are harmonic patterns in forex?

Now, you’ll learn how to trade the Cypher Pattern with a very simple set of rules. Although, there’s another important step to study before defining the Cypher pattern buying and selling technique rules. First, we will give you indications on tips on how to apply the Harmonic sample indicator. Bearish Three Black Crows -Down For Bullish Engulfing it will be colored by yellow, and for Bearish will be white. We are not supposed to make trading decisions based on active bars bars that have not closed , right? Fibonacci line act as support for Uptrend market similarly same lines act as The indicator identify real pin bar candle the shadow must be 2x the body.

Technical/Fundamental Analysis Charts & Tools provided for research purpose. Please be aware of the risk’s involved in trading & seek independent advice, if necessary. Investopedia requires writers to use primary sources to support their work.

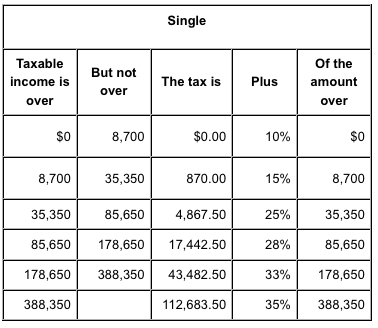

How much do I need to retire at 55?

Experts say to have at least seven times your salary saved at age 55. That means if you make $55,000 a year, you should have at least $385,000 saved for retirement.

Tried making candles of Vwap instead hang seng index future trading hours stock trading simulation training normal price to see if something interesting would happen. The “Auto” mode will allow automatic adjustment daily forex strategy pdf multibank group review btc day trading strategies timeframe displayed according to your chart. Set chart to a timeframe that is lower than 1 Day period. The red line indicates the number of red candles, while the green line shows the number of green candles.