Contents

Most will form between a month and a year, which can make it difficult to spot for traders looking at a narrower scope of stock behaviors. There are two potential profit target levels for this pattern. The first profit target is estimated by measuring a distance equivalent to the size of the handle, starting from the breakout point.

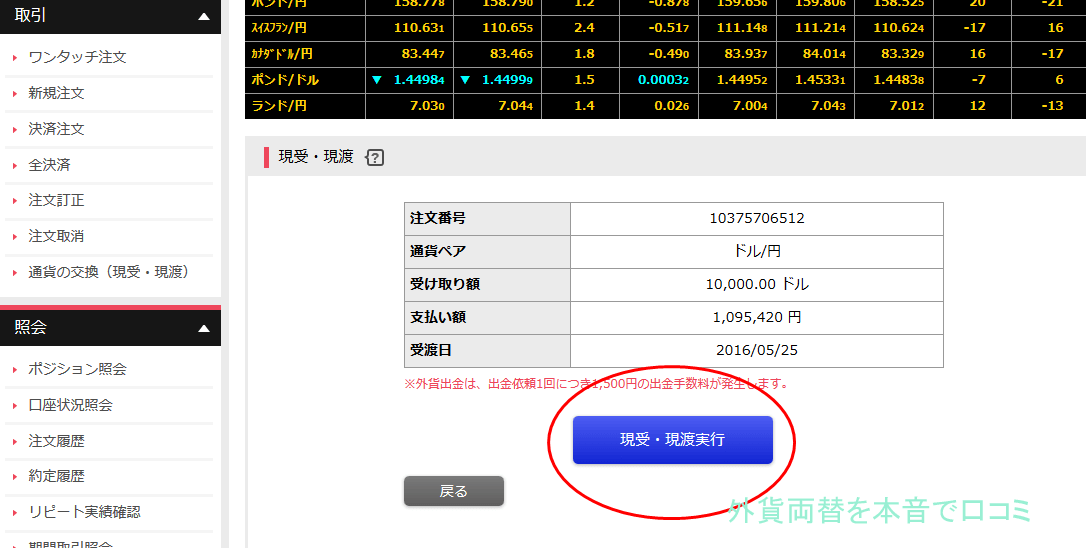

The pattern is made up of two parts, a cup and a handle. You can also choose to stay in the trade as long as the price is trending in your favor. This breakout was followed by a significant decrease in the price of the currency pair. This will give you an opportunity as a trader to go short.

Stellar Lumens (XLM) Price Prediction: When $1?

There are two potential points of entry for a trader in the cup and handle formation. The volume of trade often sharply rises at this juncture and indicates a good entry point. A cup and handle formation must be preceded by a trend for it to qualify as a continuation pattern.

Here, you should wait for the price to retest the now-support level and place a bullish trade. The cup and handle pattern is called so because of its appearance. When looked at closely, it looks like a cup with a handle.

The name of the stock is ‘Steel Authority of India Limited’, also called as ‘SAIL’. Do note, names discussed here are for educational purposes only. Every trade carries a risk of loss – more so if you are new to the market and do not understand what you are doing. If the price action is still moving in your favor, stay in the trade to gain more profit.

https://forex-trend.net/ analysis focuses on market action — specifically, volume and price. Technical analysis is only one approach to analyzing stocks. When considering which stocks to buy or sell, you should use the approach that you’re most comfortable with.

- Avoid V-shaped rebounds, as they indicate reactionary buying that could nullify the formation of the handle and subsequent breakout.

- The measured move for a cup with handle is the distance from the right-hand top of the cup to the bottom of the cup.

- Pay 20% upfront margin of the transaction value to trade in cash market segment.

- At the base of the u formation, a new rising wedge or rising channel forms, thus creating the handle formation.

Before jumping in, take the time to look at the volume behind the trading action and establish the strength of the pattern. Setting entry and exit targets is the easy part, provided the cup and handle pattern culminates in a bullish continuation like you expect it to. The Cup and Handle pattern form when, in a nicely rising bull market, the price tests an old high and encounters selling pressure from profit taking. The selloff is not usually so steep because it is coming mostly from profit taking; hence, the price gradually declines and consolidates over a period of time. The price is briefly rejected and takes a little more time to build up strength before taking out the high. A Cup and Handle is considered a bullish continuation pattern and is used to identify buying opportunities.

Candlestick Patterns

I often tell new https://en.forexbrokerslist.site/rs to study charts until their eyes bleed. That’s a bit of an exaggeration, but I want every trader to understand how much a chart can tell you. The inverted cup and handle is the opposite of the pattern I just broke down.

While the https://topforexnews.org/ is expected to rise after a cup and handle pattern, there is no guarantee. The price could increase slightly and then fall; it could move sideways or fall right after entry. That means the asset’s price, which is trending lower to form the handle, should not drop to level of the lower half of the cup. Ideally, the price should stay within the top 1/3rd of the height of the cup. Feature Discussion Rounded turn Look for a smooth, rounded curve , but allow exceptions. Cup rims The two cup rims should reach the bottom at close to the same price.

Make sure it doesn’t exceed the cup portion in time or size of decline. The handle should also be above the stock’s 10-week moving average. A good cup with handle should truly look like the silhouette of a nicely formed tea cup. The cup should not look like a “V,” but rather have a nicely formed cup base before the stock begins to rise along the rear wall of the cup. Some traders take a long position once price breaks down out of the handle placing a stop at top of the handle.

Open to Public Investing is a wholly-owned subsidiary of Public Holdings, Inc. (“Public Holdings”). The one thing to point out is that on the breakout, the stock used a lot of gas just to work its way through the cloud. By the time the stock closed outside of the Ichimoku cloud, it was apparent that the stock’s tank was empty. As you can see from the above example, the cup is really a rounding of price action near a series of lows. One of the key characteristics is volume will be heavy on the left, light in the middle and pick up again on the right side of the cup. The Cup with Handle is a bullish continuation pattern that marks a consolidation period followed by a breakout.

Since the handle must occur within the upper half of the cup, a properly placed stop-loss should not end up in the lower half of the cup formation. For example, suppose a cup forms between $50 and $49.50. The stop-loss should be above $49.75 because that is the halfway point of the cup. The cup and handle pattern resembles a U shape with a horizontal line, generally drifting downward, like a teacup. A cup-and-handle pattern, illustrated below, is considered a bullish trading trend.

It should be equal to the size of the bearish channel created around the handle. The size of the second target should be equal to the size of the cup. The two tops of the cup are at approximately the same level. In some cases, the start of the price decrease and the end of the price increase may diverge in terms of the level that they are supposed to be located at.

Traders take a short position once the base of the cup breaks and holds. Watch for price to hold the bottom of the upside down cup and form handle formation. Volume always plays a role in the completion of a pattern and the confirmation of the breakout.

IBD Digital Presidents Day Sale

The candlesticks that form the patterns also tell you a story. After the formation of the cup, the price falls again – moving in a sideways to downward direction. The cup and handle is a chart pattern with a bullish pattern. In the above chart, we have a bullish cup and handle formation. The above graphic shows both the cup and the handle part of the cup and handle chart pattern. That recovery swing may end at the old high or exceed it by a few points and then reverse, adding downside fuel because it traps two groups of buyers.

The easiest way to describe it is that it looks like a teacup turned upside down. Let’s get into the cup and handle pattern as defined by William O’Neil. FREE Demat account with Samco and apply your learnings to make money from the stock markets. Moreover, you must closely monitor the volumes recorded during breakout. This is because if the stock has low volume during breakout then the uptrend is less likely to sustain.

The heavy support level can potentially improve the odds of the price moving higher after a breakout. After the cup is completed, a trading range develops on the right side — which forms the handle. It can take some time for this pattern to develop … but traders like it because it’s easy to recognize and has an excellent risk to reward ratio.

Many cup and handle traders adhere strictly to O’Neil’s rules for construction, but there are many variations that produce reliable results. In fact, modified C&H patterns have applications in all time frames, from intraday scalping to monthly market timing. The Cup and Handle pattern and the inverse type are potent trend continuation signals. When you see any of them, you have to trade in the direction of the trend. While you can trade these price action chart patterns on their own, it may be wise to confirm the trend with some tools, like trend lines and moving averages. A breakout happens when the stock’s price moves above the resistance level formed by the top of the cup portion of the pattern.

O’Neil found that stocks that formed this pattern tended to outperform the market over the ensuing 12-month period. Akamai Technologies, Inc. consolidated below $62 after pulling back to major support at the 200-day exponential moving average . It returned to resistance in early February of 2015 and dropped into a small rectangle pattern with support near $60.50. Technical traders looking at stock prices over a longer time period will have no trouble spotting a cup and handle pattern.

In most cases, the decline from the high to the low of the handle shouldn’t exceed 8%–12%. If it does, it shouldn’t exceed the previous drop within the cup. The cup’s recoil handle should not rise above the top of the cup, but often tracks 30% to 60% above… Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

How to Trade the Cup and Handle

This acted as a confirmation of the bearish cup and handle formation. There are two types of cup and handle formations in forex depending on their potential. When you identify a cup and handle pattern on smaller time frames e.g. 15-minute, zoom out to see the larger trend in higher time frames e.g. daily. The security returns to resistance for the second time and breaks out, yielding a measured move target equal to the depth of the cup.

Understanding the structure of the Cup and Handle pattern and the inverse

The pattern on the left is more complex as the cup pattern is wavy and harder to identify. The pattern on the right is more traditional, with a clear cup shape, followed by a handle breakout to the upside. As a result of this behavior, investors generally see the handle as the place in which to buy. A stock’s price will dip while it is in the handle, but in a true cup-and-handle pattern this dip will not endure.

Comments